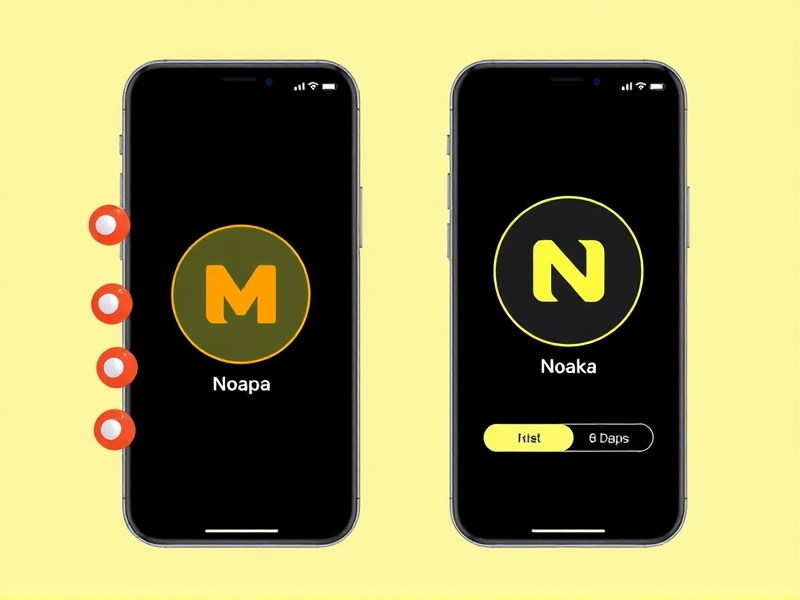

MiniPay has teamed up with Noah to facilitate the use of stablecoins for users in emerging markets. This collaboration allows individuals, including freelancers and migrant workers, to both receive and spend stablecoins via a blend of global financial networks and local payment systems.

Through this partnership, MiniPay users can receive payments in US dollars (USD) or Euros (EUR) through traditional banking channels such as ACH (Automated Clearing House) and SEPA (Single Euro Payments Area). These funds are then automatically converted into stablecoins like Tether (USDT), Circle USD Coin (USDC), or ConsenSys Dollar (cUSD). Users can keep these balances in their MiniPay wallets, spend them directly on goods and services, or withdraw them using local payment methods. Importantly, this service is non-custodial, granting users full control over their funds without the need for third-party intermediaries.

A Step Toward Practical Stablecoin Usage

MiniPay representatives view this partnership as a significant step toward making stablecoins a practical tool in everyday life. The company believes that combining global payment systems with trusted local methods enables users to earn and spend in stablecoins without the need for conversions or delays.

One of the key features of the service is direct local payments within the MiniPay app. By integrating Noah’s infrastructure, the app supports popular regional payment methods such as mobile money and bank transfers. Users can make payments directly from their wallets without converting stablecoins into fiat currencies or leaving the app.

Noah officials noted that this setup addresses common challenges in international transactions, where access to foreign bank accounts is often required, resulting in high fees. By offering virtual USD and EUR accounts linked to stablecoin balances, the solution provides a more cost-effective and accessible alternative for people in Latin America, Africa, and Asia.

This development comes as stablecoin adoption continues to rise, with a market value exceeding $150 billion. However, most current infrastructure remains focused on institutions. The new offering from MiniPay and Noah is designed to cater to retail users and small-scale earners who have often been excluded from digital finance advancements.