In recent years, the U.S. Federal Trade Commission (FTC) has noted a significant rise in financial losses among older adults due to impersonation scams, with victims over 65 experiencing more than four times the number of incidents resulting in losses exceeding $10,000.

Multicategory Impersonation Scams

According to the FTC, these scams typically fall into three main categories. The first involves a fraudster posing as an authority figure from a trusted organization and hinting at fraudulent activities on the victim’s account. In the second scenario, a scammer impersonates a government official claiming that personal data is linked to illegal actions like money laundering. Lastly, there are criminals who pretend to be from tech companies such as Microsoft or Apple, warning of potential security breaches.

The shared objective in these scams is often to initiate a conversation that can eventually lead to financial exploitation.

These tactics have proven remarkably effective, with combined losses among those who lose more than $100,000 rising eight-fold over the past four years, from $55 million to $445 million.

Mimicking Everyday Communications

Impersonation scams aren’t confined to senior citizens; younger consumers are also victims of criminals mimicking major companies like Best Buy, Amazon, and PayPal. These fraudsters use sophisticated technology to make their phishing attempts harder to identify.

A recent example involved an email that appeared genuine, complete with a legitimate-looking sender address. The message used the platform’s own features, such as money requests, but included a subtle red flag: the “to:” field contained the scammers’ actual email addresses.

Cybercriminals are becoming increasingly adept at social engineering techniques, making it difficult for consumers to detect illegitimate activities even when following standard precautions. Suzanne Sando from Javelin Strategy & Research highlighted this issue, noting that consumers might be misled into complying with requests because everything seems legitimate.

Personalized Scam Tactics

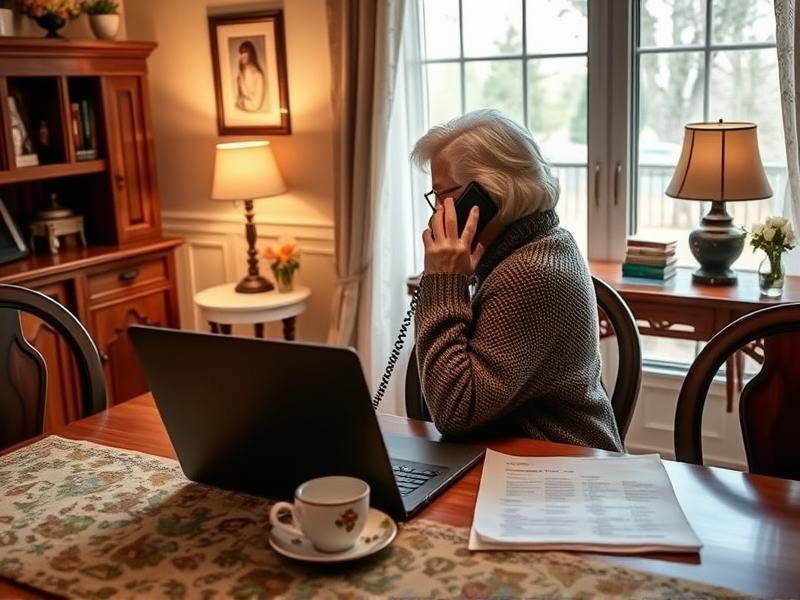

The personalized nature of these scams can make them particularly effective. While younger individuals are often targeted through social media, older adults frequently fall victim to phone calls.

Older citizens tend to trust callers more readily and may feel a sense of urgency or fear that they or someone close to them might face penalties if they don’t act immediately.

Protecting Against Scammers

To combat these increasing threats, various organizations are offering resources. Nacha’s Payments Innovation Alliance developed tools for financial institutions and consumers alike, focusing on helping vulnerable populations identify and prevent elder fraud.

The FTC also provided guidance to seniors, advising them not to transfer money under any circumstances and to immediately end communications with unverified parties before verifying the authenticity of any claims or requests.Additional advice includes using call-blocking technology to reduce interactions with potential scammers.